For decades, these three large city blocks in a prime location — straddling Miami Avenue and butting up against the Miami River and the Brickell financial district — lay inexplicably vacant.

Now, in the seeming twinkling of an eye, they have been utterly transformed. Brickell City Centre, which opened in November, is an urban animal of a concentrated intensity more evocative of Hong Kong or Tokyo than anything Miami has seen before: five towers connected by a multi-level, open-air shopping center plugged directly into a Metromover station and layered over underground parking tunneled beneath the streets. Pedestrians enter porous breezeways seamlessly from the surrounding streets, while above, shoppers cross bustling pedestrian fly-overs, protected overhead by a “climate ribbon” canopy that snakes across all three blocks like a long strip of origami.

It feels like a real city. And that’s precisely the stated goal of the relatively new, largely untested and increasingly controversial zoning category that produced it, and that now may be paving the way to a redrawing of broad swaths of Miami.

The goal: to create true urban neighborhoods and districts in underdeveloped areas of the city that, far from being self-contained islands, are painstakingly planned, interwoven and compatible with the city fabric around them. Often in exchange for greater height and density, developers must spend millions on new public spaces, streets and amenities — sometimes paying cash into public kitties — while giving city planners and the city commission a significant say in the shape of the final product.

The concept has taken off, to the consternation of some neighborhood activists. SAP was once reserved mostly to the city’s core, but developers building in far-flung, residential neighborhoods are now taking advantage.

“What the SAP does uniquely is, it sets up a table where the city comes in, stakeholders come in, and we can all figure out what the optimal shape this project can take is,” Miami planning director Francisco Garcia, who helped author the Miami 21 code while at the private planning firm Duany Plater-Zyberk, said in an interview. “In Miami, I don’t think there is any area that is not undergoing some degree of change, or redevelopment, or thinking about redevelopment. This is our world today here in Miami. So let’s approach this emphasis to redevelop and reshape the city in a creative way, and have it yield the best results.”

Aside from Brickell City Centre, which has two more planned phases yet to start, the SAP has also led to the lauded, near-total redevelopment of the formerly dormant Miami Design District. The rebirth of the district, about 60 percent complete, has meant new, street-friendly retail buildings and a pedestrian promenade connecting two large public plazas.

Aside from Brickell City Centre, which has two more planned phases yet to start, the SAP has also led to the lauded, near-total redevelopment of the formerly dormant Miami Design District. The rebirth of the district, about 60 percent complete, has meant new, street-friendly retail buildings and a pedestrian promenade connecting two large public plazas.

Meanwhile, on the north bank of the Miami River, River Landing would bring a multi-story restaurant and retail center with apartments to the site of the demolished Mahi Shrine in the Civic Center area. On the south bank, Chetrit Group’s $1 billion Miami River complex would bring 58- and 60-story towers and three levels of shops to a site formerly occupied by an abandoned restaurant and empty warehouses. Both projects would include new public spaces; Chetrit would underwrite upgrades to Jose Marti Park and contribute millions into an affordable housing trust fund.

If anything, these projects were celebrated. But as SAP applications proliferate across the city for everything from tech villages to mixed-use residential and commercial districts and even school and hospital redesigns, the sheer size and scale of some of the proposals is giving many city residents pause, if not provoking outright alarm.

Entrepreneur Moishe Mana’s massive Mana Wynwood SAP, which would bring shops, a trade center and residential towers rising up to 24 stories to two dozen acres of mostly vacant land, prompted a year of negotiation and public battles with other property owners in the rapidly redeveloping warehouse district. Mana won commission approval after agreeing to spend millions putting utilities under ground and redrawing the original plan to scale back construction facing the heart of Wynwood.

Elsewhere, developer Michael Simkins talked about using the SAP process to design an innovation center in blighted Park West immediately south of Interstate 395, including a controversial observation tower designed to also serve as a digital billboard, although his attorney says he’s currently reassessing whether to pursue an SAP.

And now a flurry of potential new SAPs has raised concerns that the process could become a runaway train barreling through established neighborhoods and dramatically changing their character. In and around the city’s Upper Eastside, three developers and a hospital have submitted applications to the city or are expected to soon, all within a tiny area of roughly 40 square blocks:

- Legions West, a 1.2-million-square-foot complex abutting Legion Park, to be built on the site of a recently demolished American Legion post and neighboring Art Deco apartment buildings that formerly housed dozens of low-income families. The developer would spend millions on improvements to the park.

- Eastside Ridge, proposed by the owners of Design Place, who want to turn 22 acres of moderately priced townhouse units into a mass of sky-high residential and office towers with nearly 3,000 condos.

- Miami Jewish Health Systems, across Second Avenue from Design Place, which is planning an expansion of an existing campus. The hospital wants to open a new dementia-focused assisted living facility, research center and convention hotel, and redesign other aspects of its campus.

- Magic City, a 15-acre assemblage including industrial buildings and a demolished trailer park straddling Little Haiti and Little River that developers Tony Cho and Bob Zangrillo want to convert into a technology, residential and cultural center.

Legions West and Eastside Ridge are perhaps the most controversial of the SAP submissions to date, in part because they would tower over neighbors and replace low-rise, low-cost rental housing. The Legions project would drop four towers up to 15 stories tall next to two protected historic districts: the MiMo Biscayne district with a 35-foot height limit, and the single-family Bayside Historic District. It would also include part of the adjacent and now-historic Legion Park in order to qualify for the needed nine acres to propose an SAP — an aspect that generated false fears that the developer, who plans to spend millions on upgrades, would privatize the park.

Renderings of the Eastside Ridge plan, which depict what seems to be a massive, gleaming steel-and-glass city-within-a city rising from the modest urban landscape of Little Haiti, has sent residents into a tizzy. Some in the community, already hyper-acute to the pressures of gentrification, believe they are being boxed in and pushed out by new development.

“The more we learn about these mammoth projects, the more concerned we are,” said Marleine Bastien, a Haitian-American activist who has been outspoken about gentrification of the neighborhood and the apparent lack of consideration for community input. “What we resent is for us to be brought in at the 11th hour when everything is cooked and ready to eat, and we get the crumbs.”

Garcia, Miami’s planning director, insists that community input is a central tenet of the Special Area Plan, which requires reams of paperwork, months of debate with city planners and multiple hearings in order to green-light a project. But some critics say there is evidence to the contrary.

“In Wynwood, they up-zoned 45 different properties to as high as 20 and 24 stories, which is a complete violation of the law,” said veteran Morningside activist Elvis Cruz, who argues that the city is flouting a Miami 21 requirement that all new development be compatible with its setting. “But that’s the way it works in the city. They just interpret things as they wish. It’s completely out of scale and character.”

People critical or skeptical of some of the newer SAPs even includes some prominent figures who have strongly backed such projects in the past. Horacio Stuart Aguirre, chairman of the Miami River Commission, which reviews projects along the waterway, said it’s one thing to approve SAPs on undeveloped land long contemplated for dense redevelopment, like the river properties close to downtown Miami, but entirely another to plunk those down amid settled, existing neighborhoods.

Though SAPs must be approved by the city commission, which has been no rubber stamp, Aguirre says he fears the “goodies” promised by developers of SAPs to the city — including new jobs, the creation of new public spaces and payments toward future affordable housing — prove too tempting to turn down. (None has been, yet.)

“Brickell City Centre is a wonderful idea, where it was done. It’s in Brickell, for crying out loud,” Aguirre said. “But should we have 20 of those reiterations all over the city? What happens to the character of individual neighborhoods? What happens to the idea of local communities?”

But Miami 21 designers say the SAP has always encouraged developers to embrace the neighborhoods in which they’re investing, and put in the extra expense, effort and time that sensitive master planning requires. They note that developers, even without SAPs, could always pursue up-zoning without providing anything in return to the community.

“They are a terrific improvement over the prior situation,” said Elizabeth Plater-Zyberk, whose firm authored the Miami 21 code. “It’s an invitation to making a better plan than what is there now.”

Garcia also says the city puts SAP proposals through a grind of an extensive review, and some submissions never make it out of the process because developers drop them after realizing what’s required for approval. He disputes the idea that developers and the city use SAPs in order to super-size projects.

“The perception by some is this is simply a race for the gluttonous,” Garcia said. “But I will tell you there are significant amounts of development capacity and density that are left on the table in each and every one of these SAPs.”

To be sure, height and density are part of the equation, but not the entire picture. What makes SAPs attractive to the city and developers is the flexibility afforded in designing what often are sprawling campuses. Roads can be moved. Buildings can be massed and shifted in ways they otherwise couldn’t. The rigidities of the city’s laws can be unlocked, although not ignored. “If I have the possibility to do that, why wouldn’t I?” asks Garcia.

Noting that the Design District SAP is hardly tall by Miami standards, Magic City’s Cho said he expects to submit an application for an SAP in part because the project he wants to build — the one he says is best for the area — is impermissible under the regular zoning code. For one thing, much of the 15 acres he and Zangrillo own are zoned industrial, and Cho says he’s hoping to include hundreds of low-cost residential units. Likely, that will be done by building “micro” units, tiny apartments made affordable by their size.

“The existing zoning is antiquated and outdated,” said Cho, who began investing years ago in Little Haiti real estate. “That’s not in the best interest of Miami. You don’t want a neighborhood that can’t develop residential.”

For Garcia, whose department hasn’t weighed in on Magic City, and has only begun to look at Eastside Ridge and Legions West, that’s the underlying truth behind Miami’s transformation. The city is evolving, and as downtown and Brickell become entirely built-out, and Wynwood’s land becomes price-prohibitive, developers will begin to invest and rebuild the city’s farther-flung neighborhoods. When that happens, he says, the city needs the tools to map out the right future.

“There has been a great explosion of building in Miami during the last six or seven years. But that’s a data-point. The real question is: Is that good? Is that bad?” he says. “It is a very positive trend and it is getting us closer to what Miami is and should be. Miami will not be in the near future a sleepy town that is a vacation resort for the wealthy. It should be a real city.”

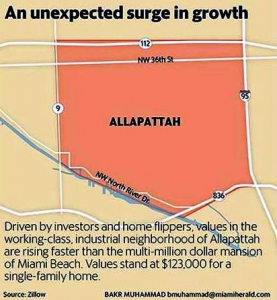

Source: Miami Herald